Remuneration policies, defined in compliance with the Company’s governance model, as well as with the recommendations contained in art. 5 of the Corporate Governance Code, pursue the general goal of attracting, retaining and motivating individuals useful for the development of the Group, recognising the responsibilities assigned to them, and guiding their actions towards the achievement of company objectives, rewarding the results obtained.

More specifically, these policies contribute to aligning the interests of management with the - priority - objective of ensuring the sustainable success of the Company, by increasing value for shareholders in the medium/long term, taking into account the interests of stakeholders, and make it possible to achieve sustainable and stable results in the short and long term in line with the Business Plan, in which the ESG (Environment, Social and Governance) aspects are integrated, to implement adequate retention of strategic positions for governance and business and, in general, to pursue the vision, mission and corporate values.

Furthermore, the long-term interests of the Company and the Group’s risk management policy are an integral part of the Group’s internal control and risk management system (which is illustrated in the Report on Corporate Governance and Ownership Structures pursuant to art. 123- bis TUF), in accordance with which the Remuneration Policy was prepared. In order to monitor these aspects, the choice has been made to hold a joint meeting between the Remuneration and Appointments Committee and the Control, Risk and Sustainability Committee of IREN S.p.A. then in office for 2025 to examine, in compliance with the functions and prerogatives of their respective competences, the 2025 Guidelines, prior to the resolutions for which the Company’s administrative body is responsible.

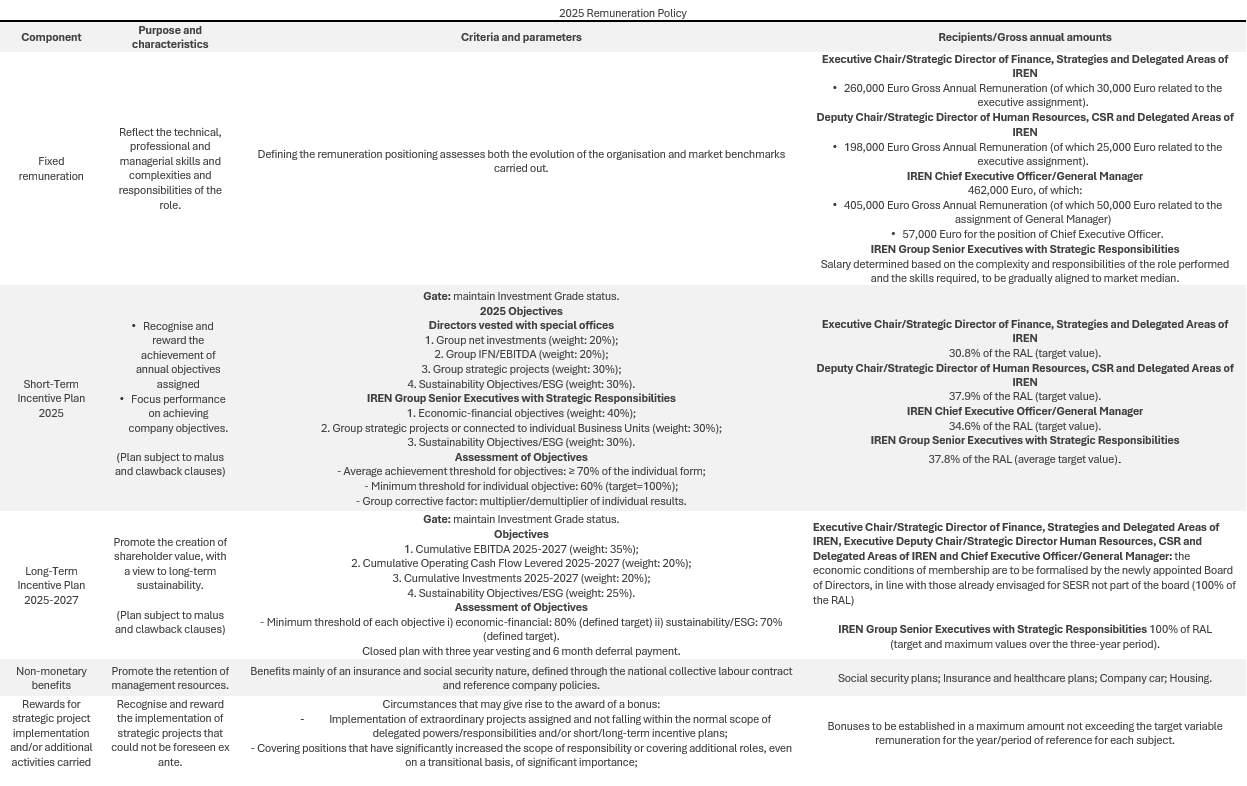

In terms of remuneration policies, the short-term incentive system for IREN Executive Directors and IREN Group Senior Executives with Strategic Responsibilities, as well as for additional resources who can contribute significantly to the achievement of the Group’s budget objectives, represents a tool intended to differentiate excellent performance without any form of automatic recognition and not linked to the achievement of assigned objectives and, in each case, pursues the goal of:

- being consistent with the Company's strategic objectives in order to promote its sustainable success;

- allowing performance to be assessed on quantitative and qualitative variables with a direct link to the company’s performance, as well as to its strategic objectives and sustainable success, in line with the company’s risk management policy;

- guaranteeing that the variable component, with respect to the fixed component, creates an incentive and is significant;

- avoiding the creation of excessively complex mechanisms, difficult to communicate and manage;

- selectively guiding individual performance, while also guaranteeing the achievement of Group and company goals.

The long-term variable remuneration component - confirmed - confirmed also for the three year-period 2025-2027 and, however, for the entire duration of the Business Plan, as a sequential succession of closed, monetary plans, subject to Regulations to be reviewed at the beginning of each three-year period, for Directors holding special offices within IREN, for IREN Group Senior Executives with Strategic Responsibilities, as well as for other resources that can make a significant contribution to achieving the objectives of the Group’s Business Plan to 2030, pursues the objective of:

- stimulating the ability to create value for the Group, rewarding the achievement of industrial, strategic and business objectives;

- guaranteeing the achievement of economic-financial and ESG objectives in the context of medium/long-term sustainability;

- strengthening the motivation of the relative beneficiaries in pursuing the strategic objectives set out in the Business Plan, aligning their interests with those of stakeholders (shareholders, customers, employees, etc.);

- attracting and motivating employees, rewarding the achievement of results and a culture of performance, as well as virtuous behaviours implemented to achieve the same;

- developing and strengthening retention policies for key company resources, making it possible to increase their sense of belonging and create incentives for them to remain with IREN Group;

- ensuring that the pay-mix (relative weights of fixed remuneration, short-term and long-term variable remuneration) is in line with market practices, without prejudice to the principle of sobriety which characterises the Company.

With regard to the non-executive Directors and the members of the Board of Statutory Auditors, the objective of the policies is to make available to the Shareholders all the elements that enable them to adopt the measures that pertain to them, by defining, in the appropriate venues, remuneration that is appropriate to the competence, professionalism and commitment required by the tasks assigned to them, as well as to the size and sector characteristics of the Company and its situation.

The process of developing the 2025 Guidelines also took into account:

- resolutions made on the issue of compensation of the Directors, adopted by the Shareholders’ Meeting on 21 June 2022, in particular the principles of the comprehensive nature of remuneration and the obligation to pay back employees and the amounts established as maximum compensation for Directors with special offices within IREN and for the remuneration of the entire board;

- the indications expressed by public Shareholders regarding the positions appointed by them pursuant to current Shareholders’ agreements;

- the overall significance of positions and roles examined;

- the results of the benchmark on the remuneration positioning of IREN Group Senior Executives with Strategic Responsibilities (lastly, with reference to the 2024 remuneration market), compared to a panel of companies of a similar size to IREN and with a particular focus on the utilities and energy sector in Italy and on similar roles in terms of content/level of responsibility, with the support of Mercer Italia.

As previously reported, the market and institutional investors’ requests concerning top management remuneration policies and best practices in the area were examined, through in-depth studies on the outcome of the Shareholders’ Meeting vote on the Report on 2024 Remuneration Policy and Remuneration Paid in 2023 submitted to the Shareholders’ Meeting held on 27 June 2024.

The criteria summarised above, as well as the principles adopted by the Shareholders’ Meeting were applied, to the extent compatible, also when the related delegated bodies determined the remuneration for IREN Group Senior Executives with Strategic Responsibilities, as established in the Corporate Governance Code.